Venice: Real Estate Sales Marketing Report, November 2013

List Prices are Neutral while Sold Prices are Appreciating.

Logic would seem to dictate that if homes are selling for more money, then list prices should go up as well. Well, list prices are going up. But, whereas sold prices have had double digit appreciation, list prices have had modest single digit appreciation.

So, how do we explain relatively stable list prices, resulting in significantly increasing sold prices? It would seem that increasing sold prices provides an opportunity for a seller to list high. However, the evidence is not supportive. The fact is that it does not serve the seller’s interest for the list price to get too far ahead of the market. This is particularly the case in the current appreciating market with low inventory. If the home is listed at a price close to its likely sold price range (fair market value), it will have many showings, offers close to or exceeding its list price, opportunity for multiple offers providing a greater net gain, and quickly go under contract.

These are the facts for Venice, November 2013 (see graphs below):

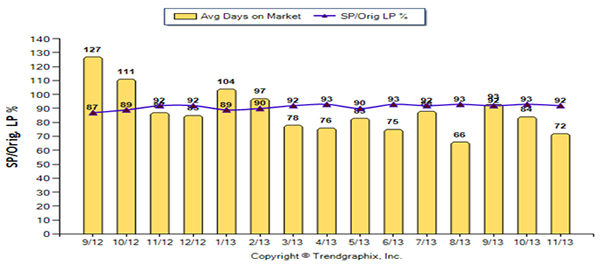

- Sold price to original list price — 92%.

- Sold price to final list price — 95%.

- Average days on the market — 72 (120 days is the historical average).

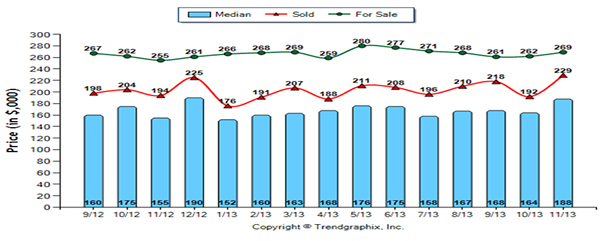

- Average for sale/list price is neutral, $269,000 — up 2.7% compared to October; up only 5.5% compared to last year.

- Average sold price is appreciating, $229,000 — up 19.3% from last month and up 18% compared to last year.

- Median sold price is appreciating $188,000 — up 14.6% from last month; up 21.3% compared to last year.

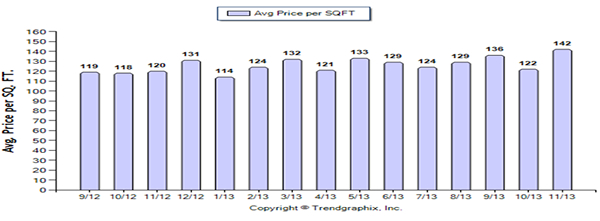

- Average sold price per square footage is appreciating $142 — up 16% from last month; up 18.4% from last year.